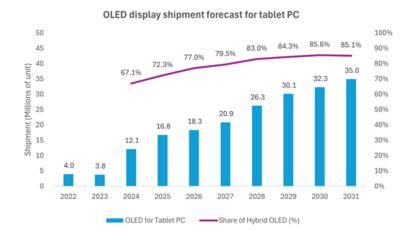

Omdia: OLED tablet shipments to reach 35 million units in 2031

Omdia says that shipments of OLED displays in tablets are set to grow in the future, rising from around 3.8 million in 2023 to 35 million in 2031. 2024 will see a 315% jump in shipments as Apple starts to adopt OLEDs in its tablets.

Interestingly, Omdia sees an increase in adoption of a 'hybrid OLED' structure (reaching a market share of 85.1% in 2031), which the company defines as a glass-based OLED with a thin-film encapsulation. This hybrid design is lower in cost compared to a flexible OLEDs, while still achieving high performance and a thin design.